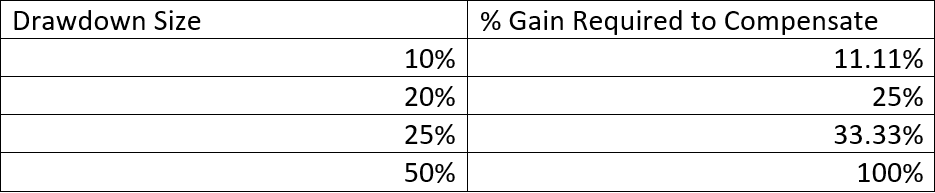

We also provide full execution services for a fully automated strategy trading solution. We offer our clients several proprietary trading systems, with strategies ranging from long-term trend following to short-term mean-reversion. Doubling the number of periods to 200 for the default values increases the chance of 45% drawdown to around 52%. The risk of drawdown also increases with number of periods tested (ultimately, risk of drawdown tends to 100% for any system). On the other hand, increasing risk per trade to 5% increases the chance of drawdown to around 45%. The tool is useful to check that decreasing risk per trade to 3% reduces the chance of drawdown to around 9%. win = 40% and win/loss ratio = 1.8), the risk of reaching a drawdown of 45% over 100 periods is around 25% when risking 4% capital per trade. This means that with the given system (prob. With the default input values, the risk of drawdown is defined at around 25%. The MC process works by iterating a random process governed by characteristics such as probability of win, payoff ratio, percentage of capital risked on each trade. The risks of ruin and drawdown are estimated via a Monte-Carlo simulation and as such are not exact values.

“Loss Level” defines the level at which the drawdown or risk of ruin is set for the test (45% means that ruin/drawdown is defined as loss of 45% capital).A longer period would increase the risk of drawdowns (and potentially ruin too). to estimate risk of ruin/drawdown over 100 periods for example). The “Periods” field represents the time horizon over which the simulation is run (i.e.The risk of ruin/drawdown is highly correlated to this value. The third field represent the percentage of capital risked ob every trade.In the default example set above, the system generates 40% of winners, with winners generating on average 1.8x the size of losers. The two first fields (probability of win and win/loss ratio) represent the system performance characteristics.Risk of drawdown, on the other hand, stays constant regardless of how high the equity grows, because the drawdown “capital barrier” keeps moving up in line with the equity. As the equity grows, the risk of hitting that “ruin threshold” decreases. For example, a risk of ruin at 45% is the probability that your initial capital falls to 55% of what you started with. Ruin is usually defined as a fixed capital level, representing a large percentage loss on initial capital. Risk of ruin is different from risk of drawdown. Just fill in the stats of the trading system, the test length and the level of drawdown/ruin to be tested and hit the Calculate button. Do not forget to subscribe to our newsletter to receive any new tools and articles we publish for trading systems (form on the right-hand side), or contact us for more info on our systems or how we can help with execution.īelow is a calculator that implements risk of ruin or risk of drawdown calculations based on the two methods described thereafter (the risk of ruin is calculated from both a Monte-Carlo simulation and from the formula). The risk of ruin and drawdown calculator below is a basic tool to help evaluate a simple system performance. It can also be useful to evaluate a trading system performance and risk. Calculate your risk of Drawdown and RuinĪs a futures broker specialised on trading systems, we offer a couple of options for our clients: ready-to-trade systems or execution of your own trading system.

0 kommentar(er)

0 kommentar(er)